South Dakota Rental Tax . Tourism tax is 1.5% applies to the gross receipts of: short term rental properties. the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. Vacation rental hosts are required to collect. April 6, 2021 doug schinkel. tax rates, set by local government bodies such as municipalities and school districts, are applied to the full market value of residential property. the property tax division is responsible for overseeing south dakota's property tax system, including property tax. learn everything there is to know about property taxes in south dakota, including how to calculate, how to take advantage of.

from itep.org

tax rates, set by local government bodies such as municipalities and school districts, are applied to the full market value of residential property. learn everything there is to know about property taxes in south dakota, including how to calculate, how to take advantage of. Tourism tax is 1.5% applies to the gross receipts of: the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. the property tax division is responsible for overseeing south dakota's property tax system, including property tax. April 6, 2021 doug schinkel. Vacation rental hosts are required to collect. short term rental properties.

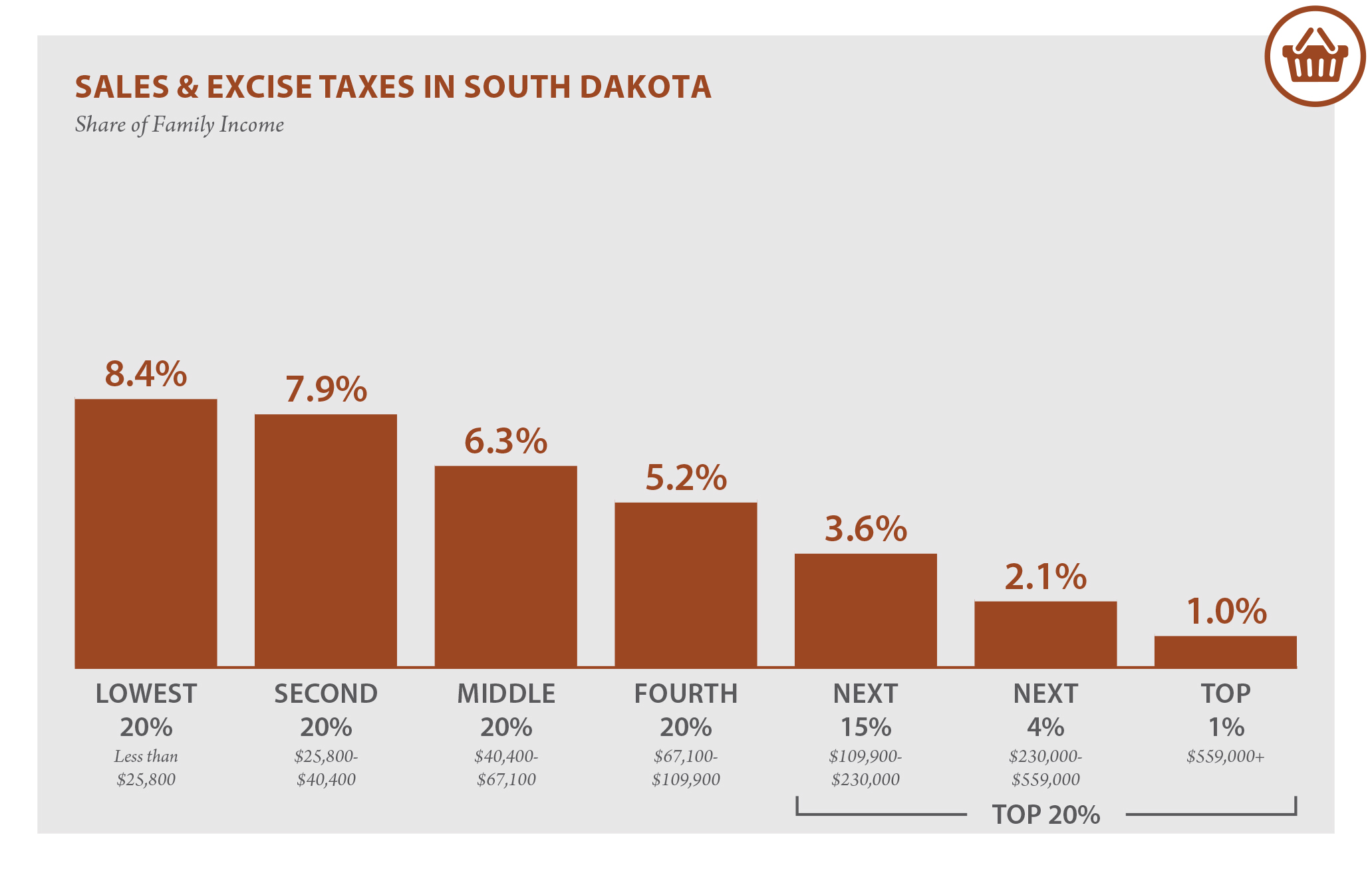

South Dakota Who Pays? 6th Edition ITEP

South Dakota Rental Tax the property tax division is responsible for overseeing south dakota's property tax system, including property tax. the property tax division is responsible for overseeing south dakota's property tax system, including property tax. Vacation rental hosts are required to collect. Tourism tax is 1.5% applies to the gross receipts of: short term rental properties. learn everything there is to know about property taxes in south dakota, including how to calculate, how to take advantage of. tax rates, set by local government bodies such as municipalities and school districts, are applied to the full market value of residential property. April 6, 2021 doug schinkel. the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any.

From taxedright.com

South Dakota Taxes Taxed Right South Dakota Rental Tax April 6, 2021 doug schinkel. learn everything there is to know about property taxes in south dakota, including how to calculate, how to take advantage of. Vacation rental hosts are required to collect. Tourism tax is 1.5% applies to the gross receipts of: the property tax division is responsible for overseeing south dakota's property tax system, including property. South Dakota Rental Tax.

From rentallease.com

Free South Dakota Rental Lease Agreement Templates PDF Word South Dakota Rental Tax the property tax division is responsible for overseeing south dakota's property tax system, including property tax. learn everything there is to know about property taxes in south dakota, including how to calculate, how to take advantage of. the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible. South Dakota Rental Tax.

From ipropertymanagement.com

South Dakota Rental Lease Agreement Template [2024 ] PDF & DOC South Dakota Rental Tax Tourism tax is 1.5% applies to the gross receipts of: learn everything there is to know about property taxes in south dakota, including how to calculate, how to take advantage of. the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. short term. South Dakota Rental Tax.

From www.formsbirds.com

South Dakota Rent and Lease Template Free Templates in PDF, Word, Excel to Print South Dakota Rental Tax the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. Vacation rental hosts are required to collect. Tourism tax is 1.5% applies to the gross receipts of: April 6, 2021 doug schinkel. short term rental properties. the property tax division is responsible for. South Dakota Rental Tax.

From rentallease.com

Free South Dakota Rental Lease Agreement Templates PDF Word South Dakota Rental Tax the property tax division is responsible for overseeing south dakota's property tax system, including property tax. short term rental properties. Vacation rental hosts are required to collect. Tourism tax is 1.5% applies to the gross receipts of: April 6, 2021 doug schinkel. the sales tax applies to the gross receipts of all retail sales, including the sale,. South Dakota Rental Tax.

From dakotafreepress.com

South Dakota Offers 7thLowest State/Local Tax Burden, But Not for Lowest 40 of Earners South Dakota Rental Tax the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. April 6, 2021 doug schinkel. the property tax division is responsible for overseeing south dakota's property tax system, including property tax. Vacation rental hosts are required to collect. learn everything there is to. South Dakota Rental Tax.

From zamp.com

Ultimate South Dakota Sales Tax Guide Zamp South Dakota Rental Tax the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. Tourism tax is 1.5% applies to the gross receipts of: tax rates, set by local government bodies such as municipalities and school districts, are applied to the full market value of residential property. . South Dakota Rental Tax.

From www.templateroller.com

South Dakota Rental Application Form Fill Out, Sign Online and Download PDF Templateroller South Dakota Rental Tax Vacation rental hosts are required to collect. the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. learn everything there is to know about property taxes in south dakota, including how to calculate, how to take advantage of. Tourism tax is 1.5% applies to. South Dakota Rental Tax.

From dxobnrmds.blob.core.windows.net

Lincoln County Property Taxes South Dakota at Carol Stanley blog South Dakota Rental Tax short term rental properties. Tourism tax is 1.5% applies to the gross receipts of: the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. the property tax division is responsible for overseeing south dakota's property tax system, including property tax. tax rates,. South Dakota Rental Tax.

From freeforms.com

Free South Dakota Rental Lease Agreement Templates PDF South Dakota Rental Tax the property tax division is responsible for overseeing south dakota's property tax system, including property tax. the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. Vacation rental hosts are required to collect. short term rental properties. learn everything there is to. South Dakota Rental Tax.

From legaltemplates.net

South Dakota Residential Lease/Rental Agreement Create & Download South Dakota Rental Tax learn everything there is to know about property taxes in south dakota, including how to calculate, how to take advantage of. April 6, 2021 doug schinkel. the property tax division is responsible for overseeing south dakota's property tax system, including property tax. the sales tax applies to the gross receipts of all retail sales, including the sale,. South Dakota Rental Tax.

From taxedright.com

South Dakota Taxes Taxed Right South Dakota Rental Tax April 6, 2021 doug schinkel. tax rates, set by local government bodies such as municipalities and school districts, are applied to the full market value of residential property. the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. Tourism tax is 1.5% applies to. South Dakota Rental Tax.

From eforms.com

Free South Dakota MonthtoMonth Lease Agreement Template PDF Word eForms South Dakota Rental Tax April 6, 2021 doug schinkel. short term rental properties. Tourism tax is 1.5% applies to the gross receipts of: the property tax division is responsible for overseeing south dakota's property tax system, including property tax. tax rates, set by local government bodies such as municipalities and school districts, are applied to the full market value of residential. South Dakota Rental Tax.

From www.formsbank.com

Fillable South Dakota Rental Application printable pdf download South Dakota Rental Tax the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. tax rates, set by local government bodies such as municipalities and school districts, are applied to the full market value of residential property. the property tax division is responsible for overseeing south dakota's. South Dakota Rental Tax.

From freeforms.com

Free South Dakota Rental Lease Agreement Templates PDF South Dakota Rental Tax short term rental properties. April 6, 2021 doug schinkel. Tourism tax is 1.5% applies to the gross receipts of: Vacation rental hosts are required to collect. the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. learn everything there is to know about. South Dakota Rental Tax.

From wikidownload.com

Download South Dakota Rental Lease Agreement Forms and Templates PDF Word wikiDownload South Dakota Rental Tax Vacation rental hosts are required to collect. Tourism tax is 1.5% applies to the gross receipts of: the property tax division is responsible for overseeing south dakota's property tax system, including property tax. learn everything there is to know about property taxes in south dakota, including how to calculate, how to take advantage of. the sales tax. South Dakota Rental Tax.

From webinarcare.com

How to Get South Dakota Sales Tax Permit A Comprehensive Guide South Dakota Rental Tax short term rental properties. the property tax division is responsible for overseeing south dakota's property tax system, including property tax. the sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any. April 6, 2021 doug schinkel. learn everything there is to know about. South Dakota Rental Tax.

From latashiaporterfield.blogspot.com

south dakota sales tax rates by city Latashia Porterfield South Dakota Rental Tax tax rates, set by local government bodies such as municipalities and school districts, are applied to the full market value of residential property. Tourism tax is 1.5% applies to the gross receipts of: learn everything there is to know about property taxes in south dakota, including how to calculate, how to take advantage of. April 6, 2021 doug. South Dakota Rental Tax.